The Internet of Things (IoT) is making quantum leaps towards the future. The industry is rapidly expanding as the markets’ needs grow beyond our wildest estimations and forecasts. Powered by the latest sensors, cutting-edge software, big data, AI (artificial intelligence), and ML (machine learning), IoT will continue to develop.

IoT also plays a vital role in the digitization of businesses. With the pandemic pushing businesses into a fully digital environment, it’s logical to assume that IoT will explode in years to come. Residential IoT use cases are also growing. In fact, the projections tell us that the number of houses with smart home systems will reach 400 million by 2025.

The IoT stats are compelling, and they indicate that IoT is definitely here to stay!

Key Internet of Things (IoT) Facts and Stats

- $749 billion was spent on IoT technology worldwide in 2020.

- There are 15.9 billion devices in the global IoT network.

- Market size for Industrial IoT is $77.3 billion.

- Consumer spending on smart home related devices worldwide is predicted to reach $88 billion by 2025.

- The largest market by IoT use case is outdoor surveillance at $7.6 million.

- The number of IoT connected devices worldwide is estimated to reach 30.9 billion units by 2025.

- The number of connected IoT devices using cellular tech reached 2 billion in 2021.

- 5G will continue to drive the growth of IoT with 5G cellular subscriptions reaching 1.9 billion by 2024.

- The chip shortage will continue to slow down IoT expansion for 2 more years.

- Companies will spend $631 million on IoT security in 2021.

General facts about IoT

There are a number of KPIs (key performance indicators) that you can consider when you want to assess a certain industry or a market. IoT has been expanding and growing for quite some time now. But how do we put that growth into context? How do we know if this is a huge market with a great future ahead of it?

From our personal experience, the best way to do this is to try and see how much money there is in the IoT game. Are both businesses and individuals interested in it? How many IoT devices are there? Let’s find answers to these questions.

1. Worldwide spending on IoT will reach $1.1 trillion by 2023.

The global COVID-19 pandemic has slowed down the rapid growth of the IoT sector. In 2020, worldwide spending on IoT technology reached $749 billion. The sector is continuing to grow but not at the pace forecasted in 2019.

Nevertheless, even with the slowdown, global spending on IoT technology will reach $1.1 trillion by 2023, which is an excellent outlook for an industry that depends on chips and is currently facing a global chip shortage.

(Source: Statista.com)

2. There will be over 400 million households with smart home systems by 2025.

One of the most engaging ways to track the popularity of IoT technology is to take a look at the adoption rates. Projections tell us that over 400 million households will have at least one smart home system installed by 2025.

This trend will impact consumer spending on both smart home services and products. According to forecasts, this spending will exceed $170 billion by 2025.

(Source: Statista.com)

3. The global IoT market size is approximately $389 billion.

The total Internet of Things (IoT) market worldwide was worth around 389 billion U.S. dollars in 2020 and is forecasted to rise to more than one trillion U.S. dollars in 2030, more than doubling its revenue in the next ten years. Also, the number of IoT-connected devices worldwide is forecast to triple during this time.

(Source: Statista.com)

4. The annual revenue of consumer internet and media devices will reach $203.1 billion by 2030.

The annual revenue of consumer internet and media devices was previously $68.7 billion in 2019. According to current projections, this revenue will grow up to $203.1 billion by 2030. That’s almost triple the 2019 revenue.

Statistics point out that IoT-connected vehicle revenue will follow the same trend. It will continue to show a significant increase to reach maximum levels by 2030.

(Source: Statista.com)

5. The number of IoT connected devices will reach 15.9 billion by 2030.

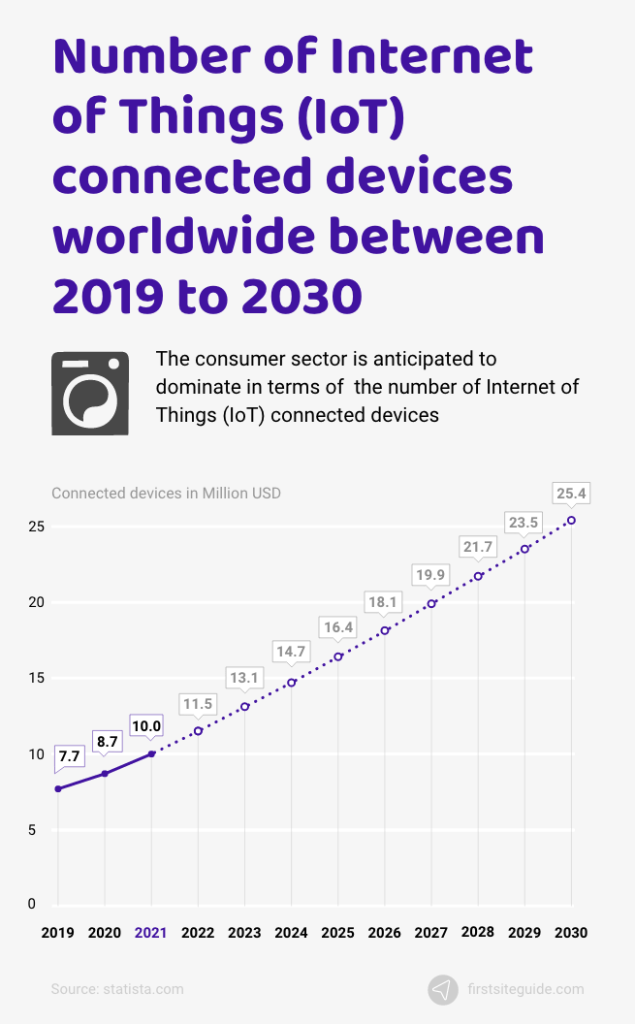

If we take a look at the forecast for the number of IoT-connected devices by vertical from 2019 to 2030, it becomes clear that the consumer sector is going to outperform all others.

By 2030, the number of consumer IoT-connected devices will reach a whopping $15.9 billion, which is more than three times more than 2019 levels.

(Source: Statista.com)

Industrial and consumer IoT segments and their performance

The world of IoT can be divided into two big segments: industrial and consumer. Tracking the KPIs of both, using markers such as market size, growth, and IoT tech adoption rates can tell us a lot about the state of IoT.

Let’s examine the most relevant statistics depicting the state of industrial and consumer IoT segments.

6. The Industrial IoT market size reached $77.3 billion in 2020.

IoT technology has found use cases across verticals that have reflected the market size of industrial IoT. In 2020, the industrial IoT market reached $77.3 billion.

(Source: Statista.com)

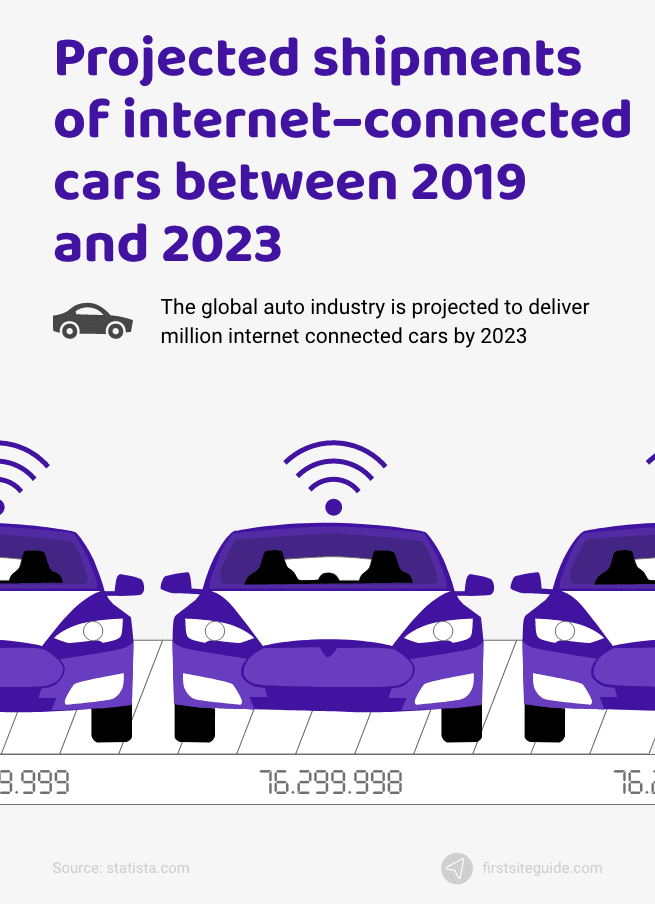

7. Approximately 70% of new vehicles worldwide will be online by 2023.

Every day, more and more cars are connected to the internet. You’ve probably noticed this yourself. But, did you know that by 2023, 70% of light-duty vehicles and trucks will be online? That’s in less than two years!

This applies to the global market. But if we narrow it down to the US market, 90% of new vehicles will be internet-connected.

(Source: Statista.com)

8. Shipments of internet-connected cars will reach 76 million units by 2023.

How many online cars is 70%? By 2023, car manufacturers will ship out 76 million units of internet-connected light-duty vehicles and trucks.

(Source: Statista.com)

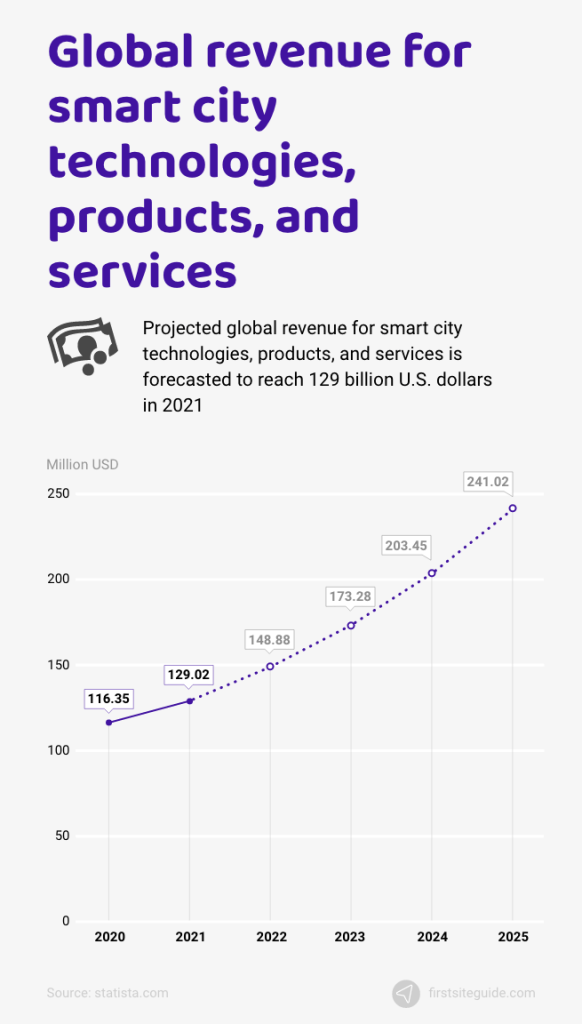

9. Global revenue for smart city tech, services, and products reached $129 billion in 2021.

IoT technology is also used in civil projects. It’s most often seen in various smart city initiatives. Global revenue for smart city tech, services, and products reached $129 billion in 2021.

This revenue comes from the sales of information and data technologies to cities. These technologies and products find their use case in the public city environment. Keep in mind that revenue also includes companies that sell connectivity technologies, including cloud computing. This revenue doesn’t encompass profits generated by IoT home product sales.

(Source: Statista.com)

10. Consumer spending on smart home tech is expected to resume pre-pandemic growth in 2021.

Consumer spending on smart home-related devices globally shows growth. However, if we take a closer look at market performance between 2019 and 2025, we can see that growth took a hit in 2020.

In 2020, the entire world was hit by the COVID-19 pandemic, which caused an economic recession. The good news is that consumer spending on smart home tech is expected to resume to pre-pandemic growth levels in 2021.

(Source: Statista.com)

11. The global agricultural IoT market value reached $4.02 billion in 2021.

IoT technology is not just reserved for homes, manufacturing verticals, and civil engineering projects. It’s also used in the agricultural industry. In fact, the global agricultural IoT market value reached $4.02 billion in 2021.

Forecasts tell us that this market will continue to grow. By 2025, it is expected to double its value and reach $7 billion, thanks to the “smart farming” movement. All global agricultural IoT sub-markets will follow the same trends, including Micro-farming Solutions, GPS Services & Field Mapping Services, Agricultural Monitoring Services, Supply Chain & Inventory Management Solutions, and Agricultural Management Platforms.

(Source: Statista.com)

12. The number of short-range IoT devices reached 10.7 billion in 2020 globally.

IoT devices that use smartphones and routers as temporary gateways to the internet reached 10.7 billion worldwide in 2020. Forecasts tell us that these numbers will reach 20.6 billion by 2026 compared to the wide-area IoT devices, which amounted to 1.9 million in 2020 and are forecasted to reach 6.3 million by 2026.

(Source: Statista.com)

13. The revenue from IoT sensors is projected to reach $43 billion by 2025.

The size of the IoT sensors market is projected to grow exponentially. In 2019, this revenue was capped at $11.9 billion. However, the income from IoT sensors worldwide is projected to reach $43 billion by 2025, which is more than 300% growth.

(Source: Statista.com)

14. Worldwide revenue of government IoT endpoint electronics and communications will reach $17.4 billion in 2021.

Governments worldwide have begun using IoT endpoint electronics and communications. Their efforts to implement IoT tech resulted in $14.7 billion in revenue in 2020. Governments will continue to adopt IoT technologies, and revenue will increase to $17.4 billion by 2021.

(Source: Statista.com)

15. The data volume of IoT connections will reach 79.4 zettabytes by 2025.

The expansion of IoT tech had to wait for better internet connections. Today, optics and the latest tech solutions in communications enable seamless IoT implementations. The data volume generated worldwide by IoT devices is enormous, and it is forecast to reach a staggering 79.4 zettabytes (ZBs) by 2025.

(Source: Statista.com)

16. The number of IoT connected devices will reach 30.9 billion by 2025.

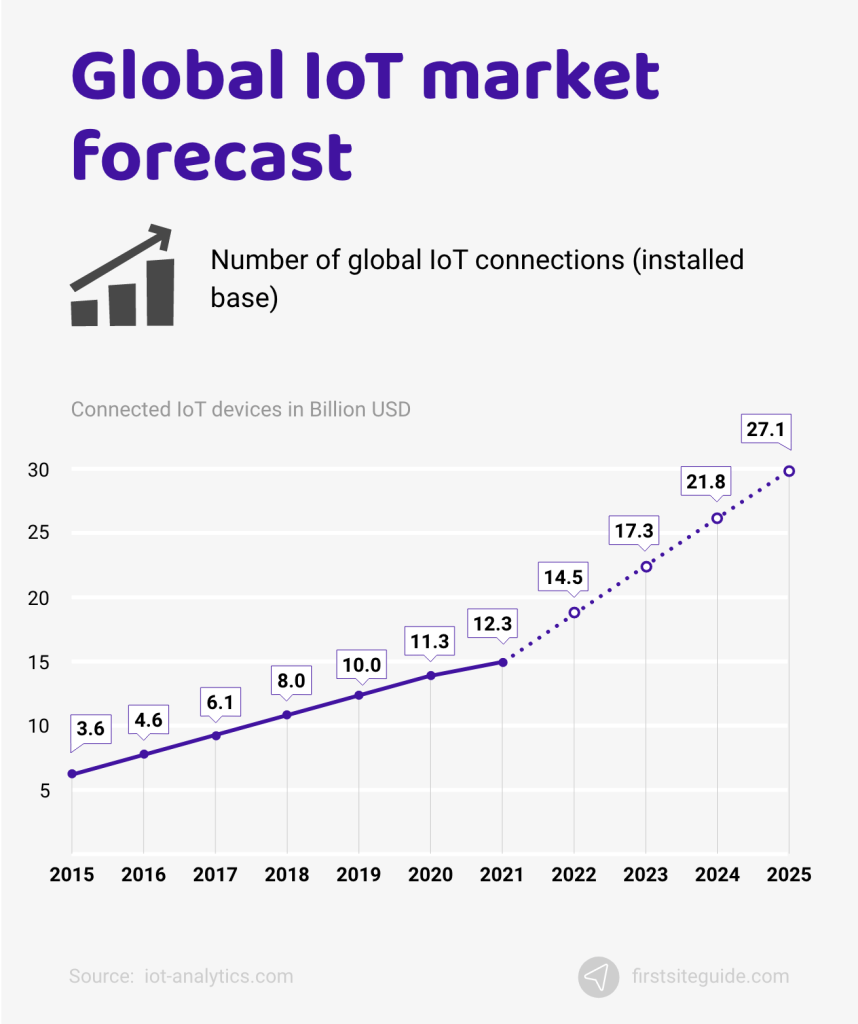

We can assess the entire IoT industry and implementation rates by simply accounting for all IoT devices with an active connection. In 2021, for instance, there were 13.8 billion IoT devices online. However, the projections tell us that this number will jump to 30.9 billion connected units by 2025. That’s more than a 100% increase!

(Source: Statista.com)

17. The growing number of IoT connections announces rapid growth of revenue from the IoT market.

IoT connections are rapidly outnumbering non-IoT connections. IoT encompasses smart home solutions, IoT equipment across verticals, and connected cars, while non-IoT connections refer to desktop computers, laptops, and smartphones.

The number of non-IoT connections is projected to reach 10 billion units by 2025. This is three times fewer than IoT device connections projected for the same year. This leads to only one conclusion – that revenue from the IoT market will show considerable growth.

(Source: Statista.com)

IoT connections and 5G IoT market share statistics

If you are not deeply involved with the IoT industry or a vertical that depends on IoT technologies, you are probably unfamiliar with online IoT devices and their market shares by regions and verticals.

If you want to learn which industry heavily depends on IoT and which region leads by the number of connected IoT devices, all you have to do is scroll down!

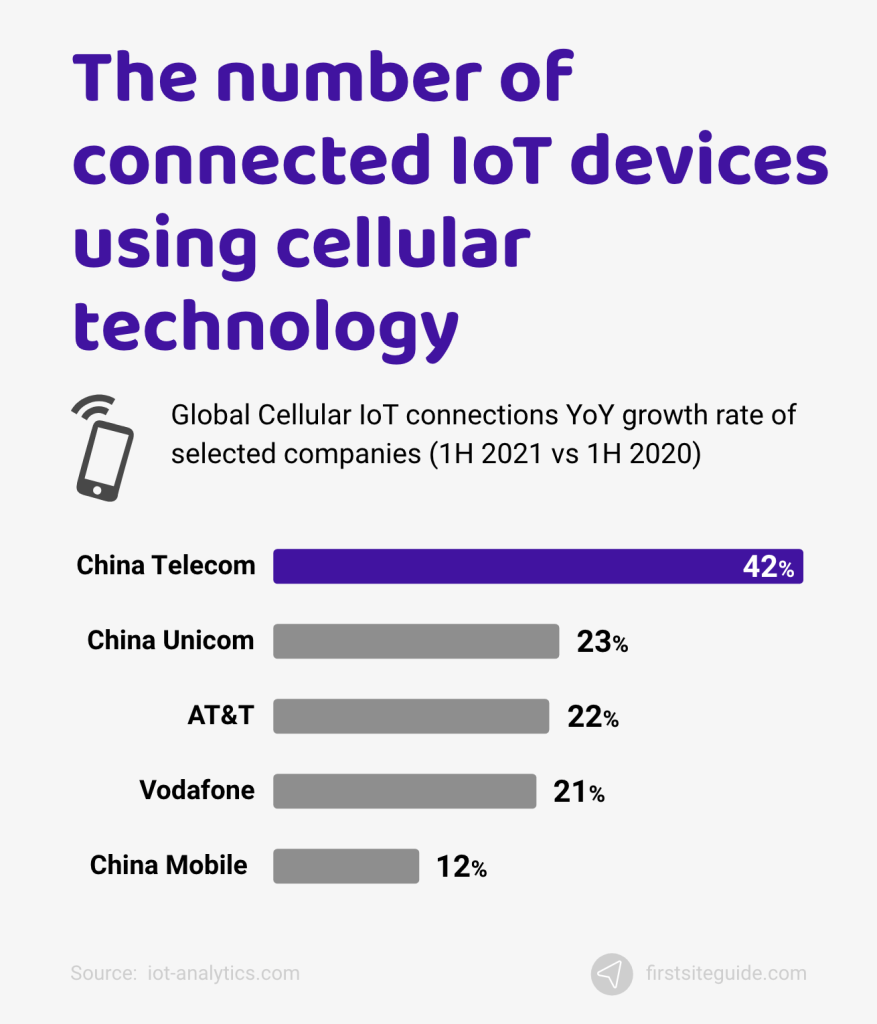

18. The number of connected IoT devices using cellular technology reached 2 billion in 2021.

The number of connected IoT devices using cellular technology is constantly increasing. More precisely, it grew 18% year-over-year. In 2021 we ended up with 2 billion online IoT devices powered by cellular tech.

(Source: Iot-analytics.com)

19. Connected cars market share is projected to account for 39% of the global 5G IoT market by 2023.

The 5G IoT endpoint market is quite diverse, but market shares tell us which sector is expanding rapidly. The largest segment of the IoT endpoint market is made up of connected cars. Forecasting tells us that connected cars’ market share will account for 39% of the entire 5G IoT endpoint market by 2023.

This roughly translates to 19 million endpoints. The overall 5G IoT endpoint installed base was 3.5 million in 2020. By 2023, it is projected to grow to 49 million.

(Source: Statista.com)

20. The total installed base of IoT connected devices will reach 30.9 billion by 2025.

The base number of installed IoT connected devices is consistently increasing, but it appears it’s about to go through exponential growth. In 2021, this number reached 13.8 billion. However, forecasts predict the number of IoT-connected devices to reach 30.9 billion by 2025, more than two times growth from 2021.

(Source: Statista.com)

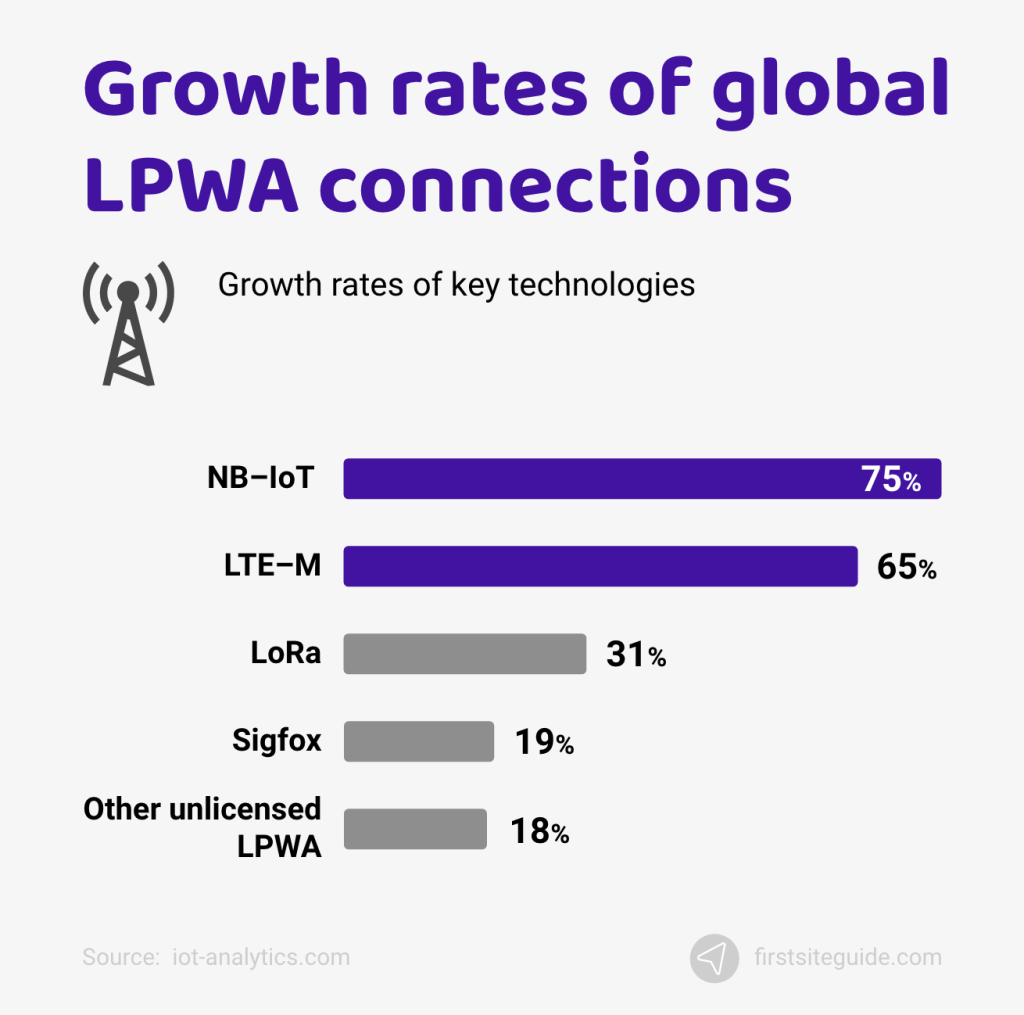

21. It took only one year between 2020 and 2021 for the licensed LPWA market to lead with 54% of market share over unlicensed LPWA with a 46% share.

In 2020, the share of connected IoT devices using licensed LPWA (low-power wide-area) was 47%, while the share of online IoT devices using unlicensed LPWA was 53%. One year later, we have the opposite situation, with licensed LPWA leading with a 54% market share over an unlicensed LPWA share of 46%.

The reason for this shift is the exponential growth of NB-IoT (narrowband-internet of things) connections, which grew 75% YoY (Year over Year) in 2021.

(Source: Iot-analytics.com)

22. The number of 5G cellular subscriptions will reach 1.9 billion by 2024.

5G continues to expand rapidly. Some of the big players in this niche, especially Ericsson, are interested in the future development of the niche. According to Ericsson, 5G will remain the main factor that drives the growth of IoT in the future.

The number of 5G cellular subscriptions will reach 1.9 billion by 2024. Compared to other markets worldwide, the North American market will grow the most, encompassing 63% of mobile subscriptions.

(Source: Ericsson.com)

23. The greater China area is going to lead with 7.7 billion IoT connected devices by 2030.

Not all regions worldwide adopt IoT tech at the same pace. Current trends point to the greater China area as the leading region. These projections tell us that the number of IoT-connected devices in this region will reach 7.7 billion by 2030.

Right behind the greater China area, we will have Europe and North America as the regions with the most IoT-connected devices.

(Source: Statista.com)

24. The number of connected IoT devices grew by 9% from 2020 to 2021 to reach 12.3 billion globally.

The number of connected IoT devices keeps on increasing. This number grew by 26% between 2015 to 2020 to reach 11.3 billion units. Growth slowed down in 2020, but it’s still substantial.

The number of devices grew by 9% to reach 12.3 billion units in 2021. Cellular IoT now surpasses 2 billion, and the number of connected IoT devices will continue to grow to reach 27.1 billion by 2025.

(Source: Iot-analytics.com)

25. The automotive sector is forecast to have a 25% share of total cellular IoT connections globally.

Not all industries adopt IoT technologies at the same rate. It appears that the automotive vertical has by far the highest adoption rates. In fact, this sector will have the most cellular IoT connections by 2025, accounting for a 25% share of total cellular IoT connections globally.

The contributing factors with the most impact on these developments include the adoption of 5G mobile tech and the growing popularity of autonomous vehicles.

(Source: Statista.com)

26. 100% of the global population will have LPWAN coverage by 2022.

LPWAN stands for low-power, wide-area network. These networks are great because they enable long-range communications, connect large numbers of devices, and reduce operational costs (low power consumption rates).

By 2022, everyone on the planet will have LPWAN coverage which will serve as the foundation for sustainable growth of the IoT sector.

(Source: Techjury.net)

27. 50% of North American and European organizations use IT automation technology.

Information technology adoption rates in organizations across regions are not identical. It appears that organizations in North America and Europe are most open to it. 50% of the organizations in these regions use IT automation technology, while 12% report that they plan to use it within the next 12 months.

According to respondents, right behind IT automation technology, we have Gigabit Wi-Fi networking as the second most popular IT trend with IT companies in 2021.

(Source: Statista.com)

The current state of the IoT market & what does the future hold?

The COVID-19 pandemic impacted almost all verticals. Unfortunately, IoT is not an exception. How did the pandemic impact IoT? Was there anything in particular that suffered the most? When will the IoT sector start recuperating?

Scroll down to find answers to these questions and discover what the future holds for IoT.

28. The number of connected IoT devices will continue to grow to reach 27 billion by 2025.

The chip shortage and the disruptions in the supply chain, all caused by the worldwide COVID-19 pandemic, are factors that negatively affect the global IoT market.

However, the market appears to be more resilient than previously anticipated. It will continue to grow. In 2021 it grew by 9% and reached 12.3 billion active endpoints. It’s forecasted to grow continuously to reach 25 billion active endpoints by 2025.

(Source: Iot-analytics.com)

29. COVID-19 affected many IoT initiatives, even canceling a few.

The IoT sector was not immune to the blow of the worldwide COVID-19 pandemic. The pandemic impacted both demand and supply across markets and verticals. IoT was not an exception.

The pandemic mostly impacted supply by increasing production times and disrupting supply chains. Demand slowly started returning to pre-pandemic levels by the end of 2020, but supply didn’t.

During 2020, we’ve seen many IoT initiatives halted or even canceled. In 2021, COVID-19 aftereffects are still shaking the foundations of IoT, mainly because of the lack of vessels, shipping containers, and port congestion.

(Source: Iot-analytics.com)

30. 11% of public companies report chip shortage as one of the main problems in 2021.

Chip shortage appears to be another factor that has negatively impacted the IoT market. In 2021, the chip shortage is expected to be a factor for up to two more years before enough additional production capacity becomes available. The current shortage is so pervasive that, of 3,000+ analyzed public companies, 11% mentioned “chip shortage” in their conference calls in the second quarter (Q2) of 2021.

(Source: Iot-analytics.com)

IoT device security statistics

Cybersecurity concerns are as old as IT technology itself. Given that IoT devices run on software and connect to the internet through routers, there are a lot of cybersecurity risks to identify and address.

Are companies spending resources on IoT security measures? Do cybercriminals target IoT devices? What do consumers think about IoT and their civil rights? Here are some statistics to help you answer these questions.

31. Spending on IoT security reached $631 million in 2021.

A promising sign for this sector’s growth is how much it invests into security. The good news for IoT is that annual spending on IoT security will reach $631 million in 2021. How do we know that the market will continue to grow and that there are buyers?

Well, annual spending on IoT security in 2016 was capped at $91 million. Companies will spend seven times more on IoT security in 2021 than they did in 2016.

(Source: Forbes.com)

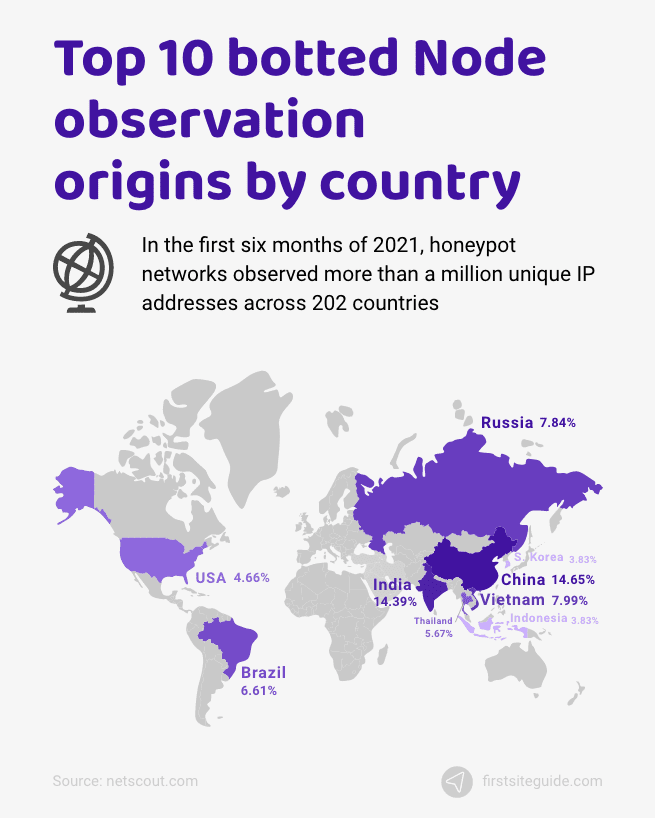

32. An average IoT device will be attacked five minutes after it goes online.

It doesn’t take hackers and malicious scripts that long to attack newly connected IoT devices. According to NETSCOUT, it takes approximately 5 minutes for an average IoT device to be attacked by hackers.

The same source states that this trend will continue to grow because more devices are bound to come online. Cybersecurity experts did predict this explosion in cyberattacks. Unfortunately, the prediction proved 100% true.

(Source: Netscout.com)

33. 75% of cyberattacks are carried out through infected routers.

Cybercriminals continuously work on identifying backdoors into networks and devices. According to Symantec, 75% of cyberattacks are carried out through infected routers. Right behind infected routers, connected cameras are a source of 15% of cyberattacks.

(Source: Symantec-enterprise-blogs.security.com)

34. 74% of global consumers see IoT as the number one threat to their civil rights.

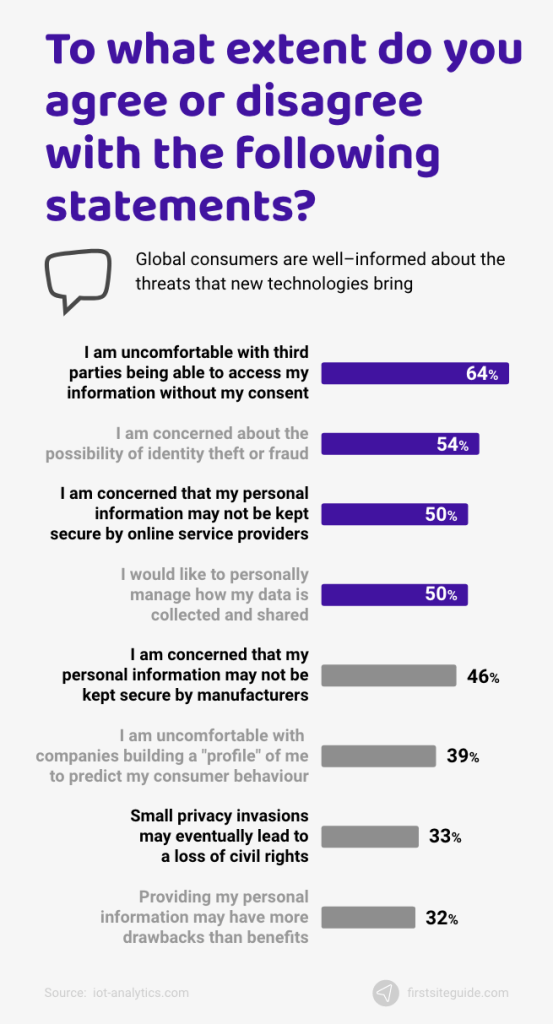

Global consumers are well-informed about the threats that new technologies bring. In fact, 74% of global consumers see IoT as the number one threat to their civil rights.

According to an Economic Intelligence Unit survey, 92% of 1,600 consumers across eight countries claimed that they want to have control over what personal information is automatically collected.

(Source: Impact.economist.com)

Conclusion

IoT is already a massive industry targeting both B2C and B2B markets. There are many moving pieces involved, making it quite hard to understand what currently takes place in the IoT industry and global markets.

That’s exactly why we’ve carefully sourced these 34 IoT statistics that we see as the most important indicators of its development.

Hopefully, you will not only find them interesting, but they will help you to understand this industry and the markets that it caters to.