A Foreign Limited Liability Company (LLC) offers many benefits such as limited liability for its owners and tax advantages.

In this article, we will explain what a Foreign LLC is, how it works, and the pros and cons of using this type of company. We will also provide steps about how to register a Foreign LLC in the United States.

Foreign limited liability company (LLC) definition

A Foreign LLC is a limited liability company that is registered in one state but conducts business in another.

Foreign LLCs are also known as out-of-state LLCs or multi-state LLCs since this type of company is often used by businesses that have operations in multiple states.

The requirements for conducting business in another state vary from state to state, but there are some common activities that would trigger the need to register your Foreign LLC in another state.

Here are some examples:

- Selling products or services online to customers in another state;

- Having employees or independent contractors who work in another state;

- Owning or renting a property in another state;

- Having a bank account in another state; and

- Incorporating or qualifying to do business in another state.

If you’re not sure if you need to register your Foreign LLC in another state, we recommend consulting with an attorney or accountant who is familiar with business law in your state.

Main reasons to consider filing as a Foreign LLC

There are a few reasons to consider filing as a Foreign LLC:

- Avoid double taxation – Foreign LLCs are not subject to double taxation, which is when a company is taxed twice on the same income.

- Limited liability – this means that if the Foreign LLC is sued, the owners will not be held personally liable for the debts of the company.

- Flexible management structure – Foreign LLCs can be managed by a single owner (known as a member) or multiple owners (known as members).

Possible penalties for not registering a Foreign LLC

If you are doing business in a state without registering as a Foreign LLC, you may be subject to penalties.

You could be required to pay a fine for operating without a Foreign LLC. Also, if you are sued, you may not be protected by the limited liability status of an LLC since you did not register as a Foreign LLC.

Pros and cons of a foreign limited liability company

Like any business structure, there are pros and cons to Foreign LLCs that you should consider before making a decision.

Pros

- Tax advantages;

- Limited liability for owners; and

- Can be managed by a single owner or multiple owners.

Cons

- Foreign LLCs can be more expensive to set up and maintain than other business structures; and

- Foreign LLCs may be subject to different rules and regulations than other business structures.

The costs of registering or qualifying a Foreign LLC

Keep in mind that costs to register a Foreign LLC vary from state to state. Typically, the filing fee is a couple of hundred dollars, but it ranges from $50 in Hawaii to $750 in South Dakota.

In some states, there may also be an annual registration or report fee.

Foreign LLCs are also required to maintain a registered agent in the state where they are conducting business. A registered agent is a person or company that agrees to receive legal documents on behalf of the Foreign LLC.

There are numerous registered agent services available on the internet for a fee.

How to register a Foreign LLC

Now that we’ve gone over the definition, purpose, and requirements of Foreign LLCs, let’s examine how to actually register one.

The process of registering a Foreign LLC is fairly simple and can be done online with just a few clicks. Here are the common steps to register a Foreign LLC:

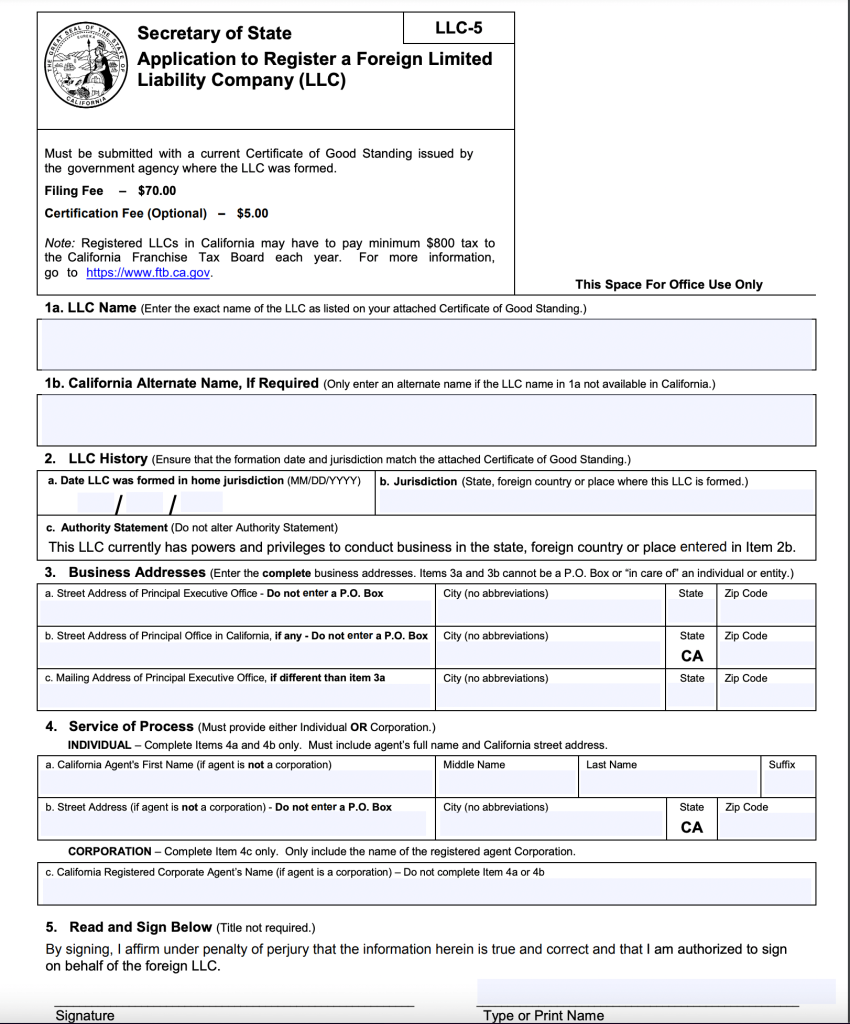

Additionally, some states may require a copy of the original Certificate of Good Standing, a Certificate of Existence, or a Certificate of Status from the state where you originally started your LLC.

Here is an example of the application to register a Foreign LLC in the state of California with the filing fee of $70 and their requirement to submit the Certificate of Good Standing:

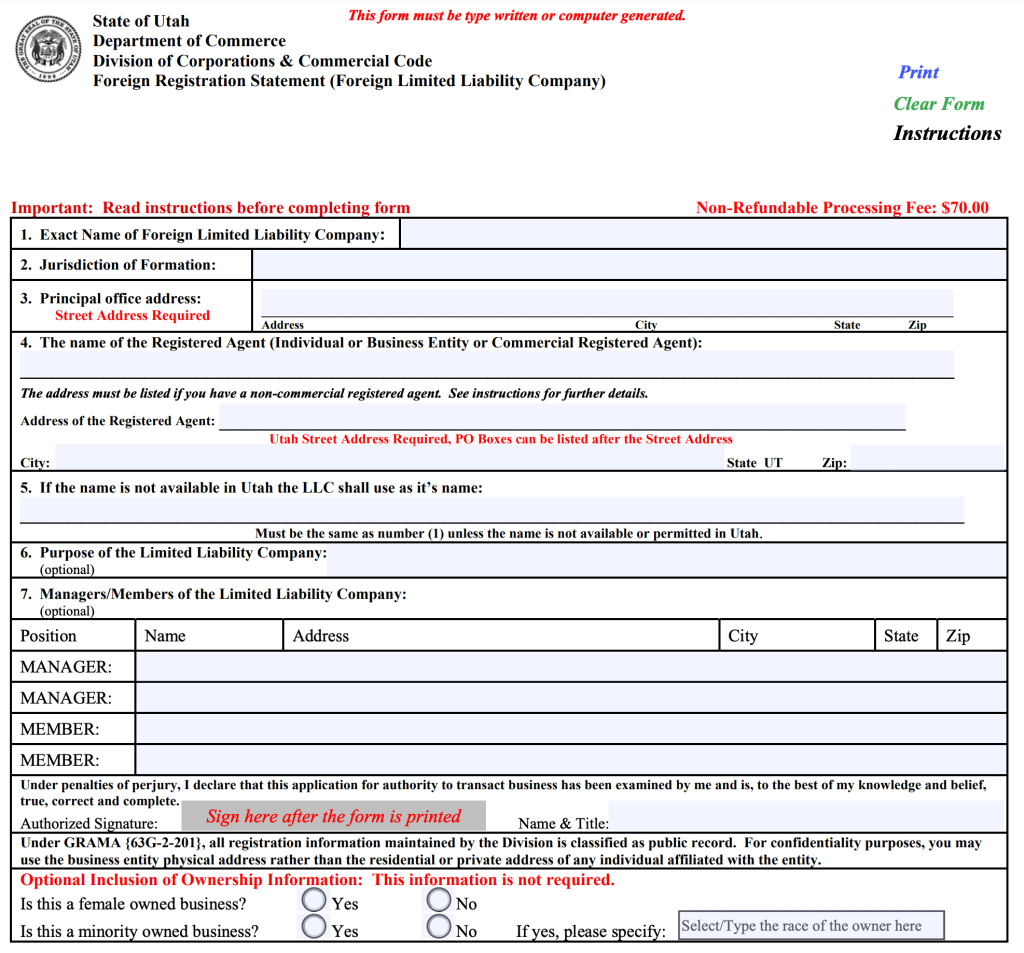

And here is another example of the application to register a Foreign LLC in the state of Utah with the same filing fee of $70:

Once a Foreign LLC has been registered and qualified to do business in a state, it can begin operating.

Conclusion

Foreign LLCs are a great way to protect your personal assets while doing business in another state.

While Foreign LLCs can be more expensive to set up and maintain than other business structures, they offer limited liability protection for owners and can be managed by a single owner or multiple owners.

If you are doing business in another state, be sure to register as a Foreign LLC to avoid penalties.